B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming a taxpayer qualifies for the exclusion treatment, the interest income on educational savings bonds:

A) Is gross income to the person who purchased the bond in the year the interest is earned.

B) Is gross income to the student in the year the interest is earned.

C) Is included in the student's gross income in the year the savings bonds are sold or redeemed to pay educational expenses.

D) Is not included in anyone's gross income if the proceeds are used to pay college tuition.

E) None of these.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

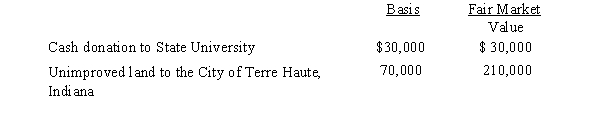

Karen, a calendar year taxpayer, made the following donations to qualified charitable organizations during the year:  The land had been held as an investment and was acquired 4 years ago.Shortly after receipt, the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction this year is:

The land had been held as an investment and was acquired 4 years ago.Shortly after receipt, the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction this year is:

A) $100,000.

B) $165,000.

C) $225,000.

D) $240,000.

E) None of the above.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Phyllis, who is single, has itemized deductions totaling $20,000.She overpaid her 2017 state income tax and is entitled to a refund of $400 in 2018.Phyllis chooses to apply the $400 overpayment toward her state income taxes for 2018.She is required to recognize that amount as income in 2018.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jack received a court award in a civil libel and slander suit against National Gossip.He received $120,000 for damages to his professional reputation, $100,000 for damages to his personal reputation, and $50,000 in punitive damages.Jack must include in his gross income as a damage award:

A) $0.

B) $100,000.

C) $120,000.

D) $270,000.

E) None of these.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Fees for automobile inspections, automobile titles and registration, bridge and highway tolls, parking meter deposits, and postage are not deductible if incurred for personal reasons, but they are deductible as deductions for AGI if incurred as a business expense by a self-employed taxpayer.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Ted earned $150,000 during the current year.He paid Alice, his former wife, $75,000 in alimony.The couple divorced in 2016.Under these facts, the tax is paid by the person who benefits from the income rather than the person who earned the income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Leona borrows $100,000 from First National Bank and uses the proceeds to purchase City of Houston bonds.The interest Leona pays on this loan is deductible as investment interest subject to the investment interest limits.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In the case of a person with other income of $300,000, 15% of his or her Social Security benefits received are excluded from gross income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under the terms of a divorce agreement entered into in 2017, Ron is to pay his former wife Jill $10,000 per month.The payments are to be reduced to $7,000 per month when their 15 year-old child reaches age 18.During the current year, Ron paid $120,000 under the agreement.Assuming all of the other conditions for alimony are satisfied, Ron can deduct from gross income and Jill must include in gross income) as alimony:

A) $120,000.

B) $84,000.

C) $36,000.

D) $0.

E) None of these is correct.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Sergio was required by the city to pay $2,000 for the cost of new curbing installed by the city in front of his personal residence.The new curbing was installed throughout Sergio's neighborhood as part of a street upgrade project.Sergio may not deduct $2,000 as a tax, but he may add the $2,000 to the basis of his property.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The amount of Social Security benefits received by an individual that he or she must include in gross income:

A) Is computed in the same manner as an annuity [exclusion = cost/expected return) × amount received].

B) May not exceed the portion contributed by the employer.

C) May not exceed 50% of the Social Security benefits received.

D) May be zero or as much as 85% of the Social Security benefits received, depending upon the taxpayer's Social Security benefits and other income.

E) None of these.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Barney is a full-time graduate student at State University.He serves as a teaching assistant for which he is paid $700 per month for 9 months and his $5,000 tuition is waived.The university waives tuition for all of its employees.In addition, he receives a $1,500 research grant to pursue his own research and studies.Barney's gross income from the above is:

A) $0.

B) $6,300.

C) $11,300.

D) $12,800.

E) None of these.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Child and dependent care expenses include amounts paid for general household services.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Judy paid $40 for Girl Scout cookies and $40 for Boy Scout popcorn.Judy may claim an $80 charitable contribution deduction.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Sam was unemployed for the first two months of 2018.During that time, he received $4,000 of state unemployment benefits.He worked for the next six months and earned $14,000.In September, he was injured on the job and collected $5,000 of workers' compensation benefits.Sam's Federal gross income from the above is $18,000 $4,000 + $14,000).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Paula transfers stock to her former spouse, Fred.The transfer is pursuant to a divorce agreement.Paula's cost of the stock was $75,000 and its fair market value on the date of the transfer is $95,000.Fred later sells the stock for $100,000.Fred's recognized gain from the sale of the stock is $5,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Brad, who uses the cash method of accounting, lives in a state that imposes an income tax including withholding from wages) .On April 14, 2018, he files his state return for 2017, paying an additional $600 in state income taxes.During 2018, his withholdings for state income tax purposes amount to $3,550.On April 13, 2019, he files his state return for 2018 claiming a refund of $800.Brad receives the refund on June 3, 2019.If he itemizes deductions, how much may Brad claim as a deduction for state income taxes on his Federal income tax return for calendar year 2018 filed in April 2019) ?

A) $3,350

B) $3,550

C) $4,150

D) $5,150

E) None of the above

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An individual generally may claim a credit for adoption expenses in the year in which the expenses are paid.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During the current year, Ralph made the following contributions to the University of Oregon a qualified charitable organization) :  Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for the year is $189,000.What is Ralph's charitable contribution deduction for the current year?

Ralph acquired the stock in Raptor, Inc., as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for the year is $189,000.What is Ralph's charitable contribution deduction for the current year?

A) $56,700

B) $63,000

C) $94,500

D) $157,500

E) None of the above

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 119

Related Exams