B) False

Correct Answer

verified

Correct Answer

verified

True/False

In general, the basis of property to a corporation in a transfer that qualifies as a nontaxable exchange under § 351 is the basis in the hands of the transferor shareholder decreased by the amount of any gain recognized on the transfer.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Gabriella and Maria form Luster Corporation with each receiving 50 shares of its stock.Gabriella transfers cash of $50,000, while Maria transfers a proprietary formula basis of $0; fair market value of $50,000).Neither Gabriella nor Maria will recognize gain on the transfer.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Jake, the sole shareholder of Peach Corporation, a C corporation, has the corporation pay him $100,000.For income tax purposes, Jake would prefer to have the payment treated as dividend instead of salary.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Under Federal tax law, a bias exists in favor of debt, as compared to equity, when financing the operations of a corporation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Erica transfers land worth $500,000, basis of $100,000, to a newly formed corporation, Robin Corporation, for all of Robin's stock, worth $300,000, and a 10-year note.The note was executed by Robin and made payable to Erica in the amount of $200,000.As a result of the transfer:

A) Erica does not recognize gain.

B) Erica recognizes gain of $400,000.

C) Robin Corporation has a basis of $100,000 in the land.

D) Robin Corporation has a basis of $300,000 in the land.

E) None of the above.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

George transfers cash of $150,000 to Finch Corporation, a newly formed corporation, for 100% of the stock in Finch worth $80,000 and debt in the amount of $70,000, payable in equal annual installments of $7,000 plus interest at the rate of 9% per annum.In the first year of operation, Finch has net taxable income of $40,000.If Finch pays George interest of $6,300 and $7,000 principal payment on the note:

A) George has dividend income of $13,300.

B) Finch Corporation does not have a tax deduction with respect to the payment.

C) George has dividend income of $7,000.

D) Finch Corporation has an interest expense deduction of $6,300.

E) None of the above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

In structuring the capitalization of a corporation, the tax law is neutral for the investor as to debt versus equity financing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Hornbill Corporation, a cash basis and calendar year C corporation, was formed and began operations on May 1, 2018.Hornbill incurred the following expenses during its first year of operations May 1 - December 31, 2018): temporary directors meeting expenses of $10,500, state of incorporation fee of $5,000, stock certificate printing expenses of $1,200, and legal fees for drafting corporate charter and bylaws of $7,500.Hornbill Corporation's 2018 deduction for organizational expenditures is $5,800.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A shareholder contributes land to his wholly owned corporation but receives no stock in return.The corporation has a zero basis in the land.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A corporation with $5 million or more in assets must file Schedule M-3 instead of Schedule M-1).

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A taxpayer transfers assets and liabilities to a corporation in return for its stock.If the liabilities exceed the basis of the assets transferred, the taxpayer will have a negative basis in the stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

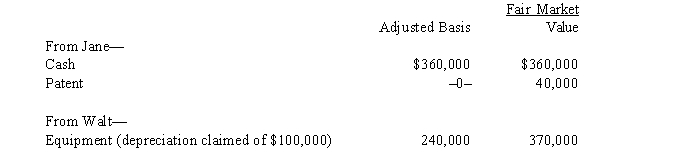

Four individuals form Chickadee Corporation under § 351.Two of these individuals, Jane and Walt, made the following contributions:  Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

Both Jane and Walt receive stock in Chickadee Corporation equal to the value of their investments.

A) Jane must recognize income of $40,000; Walt has no income.

B) Neither Jane nor Walt recognize income.

C) Walt must recognize income of $130,000; Jane has no income.

D) Walt must recognize income of $100,000; Jane has no income.

E) None of the above.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gabriella and Juanita form Luster Corporation.Gabriella transfers cash of $50,000 for 50 shares of stock, while Juanita transfers information concerning a proprietary process basis of zero and fair market value of $50,000) for 50 shares of stock.

A) The transfers to Luster are fully taxable to both Gabriella and Juanita.

B) Juanita must recognize gain of $50,000.

C) Because Juanita is required to recognize gain on the transfer, Gabriella also must recognize gain.

D) Neither Gabriella nor Juanita will recognize gain on the transfer.

E) None of the above.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

An expense that is deducted in computing net income per books but not deductible in computing taxable income is a subtraction item on Schedule M-1.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Schedule M-3 is similar to Schedule M-1 in that the form is designed to reconcile net income per books with taxable income.However, an objective of Schedule M-3 is more transparency between financial statements and tax returns than that provided by Schedule M-1.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Schedule M-2 is used to reconcile unappropriated retained earnings at the beginning of the year with unappropriated retained earnings at the end of the year.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Silver Corporation receives $1 million in cash from Madison County as an inducement to expand its operations there.Within one year, Silver spends $1.5 million to enlarge its existing plant.Silver Corporation's basis in the expansion is $500,000.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jane transfers property basis of $180,000 and fair market value of $500,000) to Green Corporation for 80% of its stock worth $425,000) and a long-term note worth $75,000) , executed by Green Corporation and made payable to Jane.As a result of the transfer:

A) Jane recognizes no gain.

B) Jane recognizes a gain of $75,000.

C) Jane recognizes a gain of $270,000.

D) Jane recognizes a gain of $320,000.

E) None of the above.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

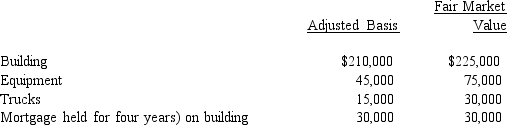

Rick transferred the following assets and liabilities to Warbler Corporation.  In return, Rick received $75,000 in cash plus 90% of Warbler Corporation's only class of stock outstanding fair market value of $225,000) .

In return, Rick received $75,000 in cash plus 90% of Warbler Corporation's only class of stock outstanding fair market value of $225,000) .

A) Rick has a recognized gain of $60,000.

B) Rick has a recognized gain of $75,000.

C) Rick's basis in the stock of Warbler Corporation is $270,000.

D) Warbler Corporation has the same basis in the assets received as Rick does in the stock.

E) None of the above.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 128

Related Exams