A) This stock is overvalued;you should consider adding it to your portfolio.

B) This stock is overvalued;you shouldn't consider adding it to your portfolio.

C) This stock is undervalued;you should consider adding it to your portfolio.

D) This stock is undervalued;you shouldn't consider adding it to your portfolio.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When he was 18,Hussam put $100 into an account at an interest rate of 8 percent.He now has $158.69 in this account.For how many years did Hussam leave this money in his account?

A) 5 years

B) 6 years

C) 7 years

D) 8 years

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At an annual interest rate of 20 percent,about how many years will it take $100 to triple in value?

A) 5

B) 6

C) 8

D) 9

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Risk-averse individuals like good things more than they dislike comparable bad things.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

According to the efficient markets hypothesis,stocks follow a random walk so that stocks that increase in price one year are more likely to increase than decrease in the next year.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct concerning stock market irrationality?

A) Bubbles could arise,in part,because the price that people pay for stock depends on what they think someone else will pay for it in the future.

B) Economists almost all agree that the evidence for stock market irrationality is convincing and the departures from rational pricing are important.

C) Some evidence for the existence of market irrationality is that informed and presumably rational managers of mutual funds generally beat the market.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As the number of stocks in a portfolio rises,

A) both firm-specific risks and market risk fall.

B) firm-specific risks fall;market risk does not.

C) market risk falls;firm-specific risks do not.

D) neither firm-specific risks nor market risk falls.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Greg's Tasty Ice Cream is considering building a new ice cream factory that costs $8.3 million.The company accountants believe that,not accounting for interest costs,building the factory will increase profits by $5 million the first year,$4 million the second year and have no value thereafter.Greg's Tasty Ice Cream should build the factory if the interest rate is

A) 3% but not if it is 4%.

B) 4% but not if it is 5%.

C) 5% but not if it is 6%.

D) 6% but not if it is 7%.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Write the formula for finding the future value of $1,000 today in 10 years if the interest rate is 4 percent.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The risk of a portfolio

A) increases as the number of stocks in the portfolio increases.

B) is usually measured using a statistic called the standard diversification.

C) is positively related to the average return of the portfolio.

D) bears no relationship to the average return of the portfolio.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tonya put $250 into an account three years ago.The first year he earned 6 percent interest,the second year 7 percent,and the third year 8 percent.About how about much does Tonya have in her account now?

A) $302.50

B) $306.23

C) $308.67

D) $309.39

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A car salesperson gives you four alternative ways to pay for your car.The first is to pay $18,000 today.The second is to pay $19,000 one year from today.The third is to pay $20,300 two years from today.The fourth is to pay $21,500 three years from today.If the interest rate is 6 percent,which payment option has the lowest present value and which has the highest?

A) The first is lowest;the second is highest.

B) The second is lowest;the third is highest.

C) The third is lowest;the fourth is highest.

D) The fourth is lowest;the first is highest.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You could borrow $1,000 today from Bank A and repay the loan,with interest,by paying Bank A $1,060 one year from today.Or,you could borrow $1,500 today from Bank B and repay the loan,with interest,by paying Bank B $1,600 one year from today.Which of the following statements is correct?

A) The interest rate on the loan from Bank A is higher than the interest rate on the loan from Bank B.

B) The interest rate on the loan from Bank A is lower than the interest rate on the loan from Bank B.

C) The interest rates on the two loans are the same.

D) There is not enough information to determine which loan has the higher interest rate.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

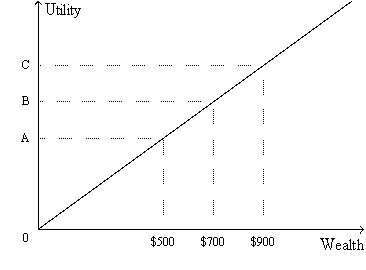

Figure 14-3.The figure shows a utility function for Rob.  -Refer to Figure 14-3.If most people's utility functions look like Rob's utility function,then it is easy to explain why

-Refer to Figure 14-3.If most people's utility functions look like Rob's utility function,then it is easy to explain why

A) people buy various types of insurance.

B) we observe a trade-off between risk and return.

C) most people prefer to hold diversified portfolios of assets to undiversified portfolios of assets.

D) None of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

A person's subjective measure of well-being or satisfaction is called aversion.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the interest rate is 4%,in which of the following cases is the future value the largest?

A) An initial value of $1,000 deposited for 5 years.

B) An initial value of $950 deposited for 6 years.

C) An initial value of $900 deposited for 7 years.

D) An initial value of $850 deposited for 8 years.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Three years ago Heidi put $1,200 into an account paying 2 percent interest.How much is the account worth today?

A) $1,225.38

B) $1,248.48

C) $1,264.72

D) $1,273.45

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The word "efficient" in the term "efficient markets hypothesis" refers to the idea that

A) fundamental analysis is an efficient way to go about choosing which stocks to buy or sell.

B) stock prices move upward and downward "efficiently," rather than following a "random walk."

C) the stock market is "informationally efficient."

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Diversification cannot reduce market risk.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Of the following interest rates,which is the highest one at which you would prefer to have $170 ten years from today instead of $100 today?

A) 3 percent

B) 5 percent

C) 7 percent

D) 9 percent

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 341 - 360 of 461

Related Exams