A) $15,000.

B) $20,000.

C) $25,000.

D) $30,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which two of the Ten Principles of Economics are illustrated in this chapter?

A) A country's standard of living depends on its ability to produce goods & People face tradeoffs.

B) Prices rise when the government prints too much money & Governments can sometimes improve market outcomes.

C) Governments can sometimes improve market outcomes & People face tradeoffs.

D) People face tradeoffs & Prices rise when the government prints too much money .

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following groups has the lowest poverty rate?

A) blacks

B) Asians

C) children (under age 18)

D) female households,no spouse present

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the Ten Principles of Economics do governments run into when they redistribute income to achieve greater equality?

A) Trade can make everyone better off.

B) The cost of something is what you give up to get it.

C) People face trade-offs.

D) Markets are usually a good way to organize economic activity.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

According to a study by Michael Cox and Richard Alm,consumption per person in the richest 20% of households was only 2.1 times consumption per person in the poorest 20% of households.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to utilitarians,the ultimate objective of public actions should be to

A) enhance the income of the rich.

B) ensure an egalitarian distribution of income.

C) maximize the sum of individual utility.

D) provide for the betterment of the poor.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The study by economists Cox and Alm found that the 2006 pre-tax income of the richest fifth of U.S.households is

A) 5 times the pre-tax income of the poorest fifth.

B) 10 times the pre-tax income of the poorest fifth.

C) 15 times the pre-tax income of the poorest fifth.

D) 20 times the pre-tax income of the poorest fifth.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to Scenario 20-1.Assuming that utility is directly proportional to the cash value of after-tax income,which government policy would an advocate of utilitarianism prefer?

A) Plan A

B) Plan B

C) either Plan A or Plan B

D) neither Plan A nor Plan B because any plan that forcibly redistributes income is against the philosophy

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A commonly-used gauge of poverty is the

A) income inequality rate.

B) average income rate.

C) poverty rate.

D) social inequality rate.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A utilitarian government has to balance the gains from greater income equality against the losses from distorted work incentives.To maximize total utility,therefore,the government

A) would never tax labor income.

B) must always achieve a fully egalitarian society.

C) enacts policies that only benefit the middle class.

D) stops short of a fully egalitarian society.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

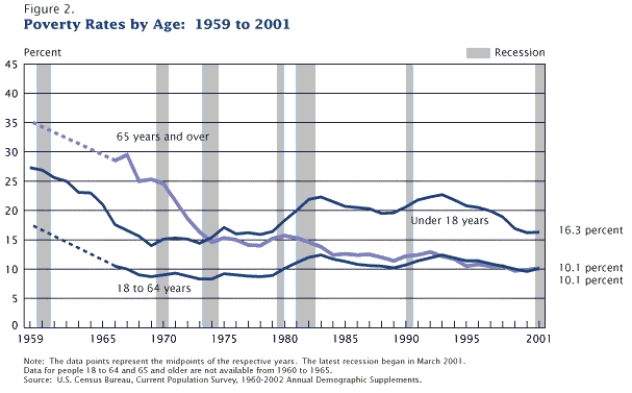

Figure 20-4

Poverty Rates by Age  -Refer to Figure 20-4.From 1969 to 2001,the percent of elderly aged 64 and over in poverty has

-Refer to Figure 20-4.From 1969 to 2001,the percent of elderly aged 64 and over in poverty has

A) declined,while the percentage of children under age 18 in poverty has also declined.

B) declined,while the percentage of children under age 18 in poverty has increased.

C) increased,while the percentage of children under age 18 in poverty has declined.

D) increased,while the percentage of children under age 18 in poverty has also increased.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In 2008 the top 5 percent of income earners accounted for over 50% of all income received by United States' families.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The income level below which families are said to be poor is known as the

A) income maintenance threshold.

B) poverty line.

C) bottom quintile of the income distribution.

D) minimum wage.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The maximin criterion is the idea that the government should aim to maximize the well-being of the worst-off person in society.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

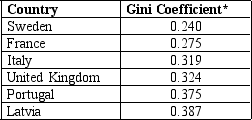

Table 20-5

*A Gini coefficient is a commonly used measure of income inequality,with values between 0 and 1 (0 corresponds to perfect equality whereby everyone has exactly the same income,and 1 corresponds to perfect inequality where one person has all the income,while everyone else has zero income) .

Source: The World Bank

-Refer to Table 20-5.Which country has the most unequal income distribution?

*A Gini coefficient is a commonly used measure of income inequality,with values between 0 and 1 (0 corresponds to perfect equality whereby everyone has exactly the same income,and 1 corresponds to perfect inequality where one person has all the income,while everyone else has zero income) .

Source: The World Bank

-Refer to Table 20-5.Which country has the most unequal income distribution?

A) Latvia

B) Italy

C) France

D) Sweden

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) The distribution of annual income accurately reflects the distribution of living standards.

B) Permanent incomes are more equally distributed than annual incomes.

C) Transitory changes in income generally have a significant impact on a family's standard of living.

D) Annual income is more equally distributed than permanent income.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The goal of libertarianism is to

A) redistribute income based on the assumption of diminishing marginal utility.

B) redistribute income in order to maximize the well-being of the worst-off person in society.

C) punish crimes and enforce voluntary agreements but not to redistribute income.

D) measure happiness and satisfaction.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The utilitarian case for redistributing income is based on the assumption of

A) collective consensus.

B) a notion of fairness engendered by equality.

C) diminishing marginal utility.

D) rising marginal utility.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is most likely to occur when the government enacts policies to make the distribution of income more equal?

A) a more efficient allocation of resources

B) a distortion of incentives

C) unchanged behavior

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A binding minimum wage

A) affects employees but not employers.

B) lowers the productivity of workers.

C) raises the cost of labor to firms.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 399

Related Exams