A) economic mobility.

B) place in the economic life cycle.

C) transitory income.

D) permanent income.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that the government proposes a negative income tax that calculates the taxes owed as follows: Taxes Owed = (1/3

Income) - 10,000.If a family doesn't earn any income,how does the negative income tax affect it?

Income) - 10,000.If a family doesn't earn any income,how does the negative income tax affect it?

A) It will receive an income subsidy of $1,000.

B) It will receive an income subsidy of $3,000.

C) It will receive an income subsidy of $10,000.

D) It will not be affected at all,since the negative income tax requires a family to earn income.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A common criticism of government programs that are designed to assist the poor is that

A) those who receive assistance rarely meet the criterion for eligibility.

B) the majority of those below the poverty line refuse to accept government assistance.

C) they create incentives for people to become "needy."

D) they typically account for a majority of annual government expenditures.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The marketplace allocates resources

A) fairly.

B) efficiently.

C) to those desiring them least.

D) both efficiently and equitably.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Refer to Scenario 20-1.Assuming that utility is directly proportional to the cash value of after-tax income,which government policy would an advocate of liberalism prefer?

A) Plan A

B) Plan B

C) either Plan A or Plan B

D) neither Plan A nor Plan B because any plan that forcibly redistributes income is against the philosophy

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The United States has more income inequality than Japan,Germany,and Canada.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose society consists of three individuals: Andy,Bill,and Carl.Andy has $20,000 of income,Bill has $40,000 of income,and Carl has $60,000 of income.A utilitarian would argue that

A) taking $1 from Carl and giving it to Andy would increase society's total utility.

B) taking $1 from Carl and giving it to Bill would increase society's total utility.

C) taking $1 from Bill and giving it to Andy would increase society's total utility.

D) All of the above are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Binding minimum-wage laws

A) are most effective at alleviating poverty when labor demand is highly elastic.

B) force a market imbalance between the supply and demand for labor.

C) increase the efficiency of labor markets.

D) are typically associated with a rise in employment among the poor.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a society consists of only two people,John and Jane.A utilitarian would say that the proper role of government in this society is to

A) equalize the incomes of John and Jane.

B) equalize John's utility and Jane's utility.

C) equalize John's marginal utility and Jane's marginal utility.

D) maximize the sum of John's utility and Jane's utility.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For which of the following programs can a person qualify solely by having a low income?

A) both Temporary Assistance for Needy Families (TANF) and Supplemental Security Income (SSI)

B) Temporary Assistance for Needy Families (TANF) but not Supplemental Security Income (SSI)

C) Supplemental Security Income (SSI) but not Temporary Assistance for Needy Families (TANF)

D) neither Temporary Assistance for Needy Families (TANF) nor Supplemental Security Income (SSI)

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Government programs that take money from high-income people and give it to low-income people typically

A) improve economic efficiency by reducing poverty.

B) reduce economic efficiency because they distort incentives.

C) have no effect on economic efficiency because they both reduce poverty and distort incentives.

D) sometimes improve,sometimes reduce,and sometimes have no effect on economic efficiency.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Minimum wage laws

A) benefit all unskilled workers.

B) create unemployment,but if demand is relatively elastic,the unemployment effects will be minor.

C) may help the nonpoor,such as teenagers from wealthy families.

D) reduce poverty by reducing unemployment.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

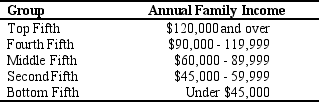

Table 20-3

The Distribution of Income in Hapland

-Refer to Table 20-3.According to the table,what percent of families in Hapland have income levels above $60,000?

-Refer to Table 20-3.According to the table,what percent of families in Hapland have income levels above $60,000?

A) 80 percent

B) 60 percent

C) 50 percent

D) 40 percent

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Income mobility studies suggest that poverty

A) cannot be alleviated by privately sponsored anti-poverty programs.

B) cannot be alleviated by government sponsored anti-poverty programs.

C) is a long-term problem for a relatively large number of families.

D) is not a long-term problem for most families.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

About half of black and Hispanic children in female-headed households live in poverty.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Which political philosophy argues that the govenment should choose policies deemed just,as evaluated by an impartial observer?

Correct Answer

verified

Correct Answer

verified

True/False

The poverty line is an absolute standard and is based on the cost of providing an adequate diet.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a welfare program?

A) Temporary Assistance for Needy Families (TANF) .

B) Capital Gains Tax (CGT) .

C) Life Cycle Transfers (LCT) .

D) North American Free Trade Agreement (NAFTA) .

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is correct?

A) A disadvantage of a minimum-wage law is that it may benefit unskilled workers who are not low-income workers.

B) A disadvantage of a negative income tax program is that a poor person who chooses not to work many hours would receive a cash benefit.

C) A disadvantage of an Earned Income Tax Credit (EITC) is that a person who is unable to work due to a disability does not benefit from the program.

D) All of the above are correct.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The invisible hand of the marketplace acts to allocate resources

A) efficiently but does not necessarily ensure that resources are allocated fairly.

B) both fairly and efficiently.

C) fairly but does not necessarily ensure that resources are allocated efficiently.

D) neither fairly nor efficiently.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 321 - 340 of 399

Related Exams