A) lower rent and higher quality housing.

B) lower rent and lower quality housing.

C) higher rent and a shortage of rental housing.

D) higher rent and a surplus of rental housing.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A binding minimum wage creates a surplus of labor.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

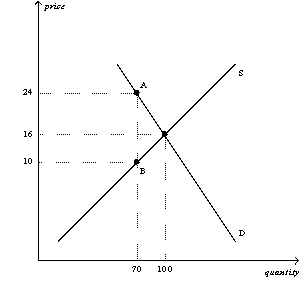

Figure 6-14

The vertical distance between points A and B represents the tax in the market.  -Refer to Figure 6-14.The price that buyers pay after the tax is imposed is

-Refer to Figure 6-14.The price that buyers pay after the tax is imposed is

A) $8.

B) $10.

C) $16.

D) $24.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Workers with high skills and much experience are not typically affected by the minimum wage.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a tax is placed on the buyers of lemonade,the

A) sellers bear the entire burden of the tax.

B) buyers bear the entire burden of the tax.

C) burden of the tax will be always be equally divided between the buyers and the sellers.

D) burden of the tax will be shared by the buyers and the sellers,but the division of the burden is not always equal.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is correct? A tax burden

A) falls more heavily on the side of the market that is more elastic.

B) falls more heavily on the side of the market that is less elastic.

C) falls more heavily on the side of the market that is closest to unit elastic.

D) is distributed independently of the relative elasticities of supply and demand.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sellers of a good bear the larger share of the tax burden when a tax is placed on a product for which the (i) Supply is more elastic than the demand. (ii) Demand in more elastic than the supply. (iii) Tax is placed on the sellers of the product. (iv) Tax is placed on the buyers of the product.

A) (i) only

B) (ii) only

C) (i) and (iv) only

D) (ii) and (iii) only

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the sellers of a product,then there will be a(n)

A) downward shift of the demand curve.

B) upward shift of the demand curve.

C) movement up and to the left along the demand curve.

D) movement down and to the right along the demand curve.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

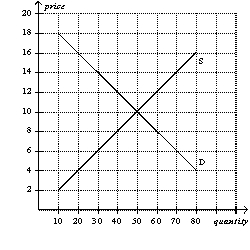

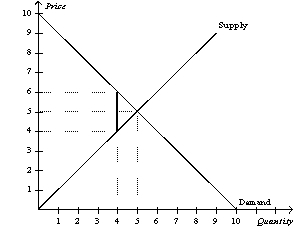

Figure 6-6  -Refer to Figure 6-6.Which of the following price ceilings would be binding in this market?

-Refer to Figure 6-6.Which of the following price ceilings would be binding in this market?

A) $8

B) $10

C) $12

D) $14

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

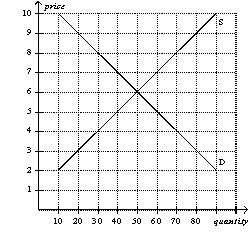

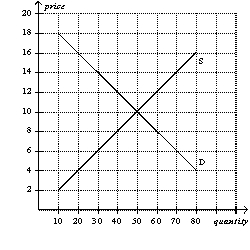

Figure 6-7  -Refer to Figure 6-7.Which of the following price controls would cause a shortage of 20 units of the good?

-Refer to Figure 6-7.Which of the following price controls would cause a shortage of 20 units of the good?

A) a price ceiling set at $4

B) a price ceiling set at $5

C) a price floor set at $7

D) a price floor set at $8

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

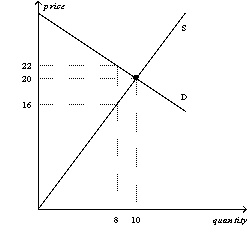

Figure 6-3

This figure shows the market demand and market supply curves for good Z.  -Refer to Figure 6-3.Suppose a tax of $6 per unit is imposed on this market.How much will buyers pay per unit after the tax is imposed?

-Refer to Figure 6-3.Suppose a tax of $6 per unit is imposed on this market.How much will buyers pay per unit after the tax is imposed?

A) $16

B) between $16 and $20

C) between $20 and $22

D) $22

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rent control

A) is an example of a price ceiling.

B) leads to a larger shortage of apartments in the long run than in the short run.

C) leads to lower rents and,in the long run,to lower-quality housing.

D) All of the above are correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the government removes a tax on a good,then the price paid by buyers will

A) increase,and the price received by sellers will increase.

B) increase,and the price received by sellers will decrease.

C) decrease,and the price received by sellers will increase.

D) decrease,and the price received by sellers will decrease.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The minimum wage,if it is binding,lowers the incomes of

A) no workers.

B) only those workers who become unemployed.

C) only those workers who have jobs.

D) all workers.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Figure 6-27  -Refer to Figure 6-27.If the government places a $2 tax in the market,the buyer bears $1 of the tax burden.

-Refer to Figure 6-27.If the government places a $2 tax in the market,the buyer bears $1 of the tax burden.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Figure 6-6  -Refer to Figure 6-6.Which of the following statements is correct?

-Refer to Figure 6-6.Which of the following statements is correct?

A) A price ceiling set at $12 would be binding,but a price ceiling set at $8 would not be binding.

B) A price floor set at $8 would be binding,but a price ceiling set at $8 would not be binding.

C) A price ceiling set at $9 would result in a surplus.

D) A price floor set at $11 would result in a surplus.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Even though federal law mandates that workers and firms each pay half of the total FICA tax,the tax burden may not fall equally on workers and firms.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose that in a particular market,the demand curve is highly elastic,and the supply curve is highly inelastic.If a tax is imposed in this market,then the

A) buyers will bear a greater burden of the tax than the sellers.

B) sellers will bear a greater burden of the tax than the buyers.

C) buyers and sellers are likely to share the burden of the tax equally.

D) buyers and sellers will not share the burden equally,but it is impossible to determine who will bear the greater burden of the tax without more information.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The quantity sold in a market will increase if the government

A) decreases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) decreases a tax on the good sold in that market.

D) More than one of the above is correct.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Rent control may lead to lower rents for those who find housing,but the quality of the housing may also be lower.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 593

Related Exams